Trickle-Down Economics: Why OBBB Tax Cuts Will Fail

AI Generated Graphic. Thanks Google Gemini

Historical Precedent

The trickle-down theory is most often associated with Ronald Reagan and termed Reganomics due to his 1981 and 1986 Tax Acts.

According to the theory, reducing heavy taxes on large corporations would allow them to share those savings with their workers, which could in turn boost economic growth. It didn’t work then and won’t work now. And yet, the One Big Beautiful Bill (OBBB) embraces this failed economic policy. There’s a reason they call it “trickle-down economics.

Tax Incentives Favor the Rich

Through the combined efforts of two separate tax initiatives, the Economic Recovery Tax Act of 1981 and the 1986 Tax Reform Act, big business saw their tax rates drop from 70% to 34%. It wasn’t just the tax rates that plummeted. Rules regarding depreciation were changed to provide greater advantages for business owners. Corporate tax reduction and income inequality are simpatico bed partners.

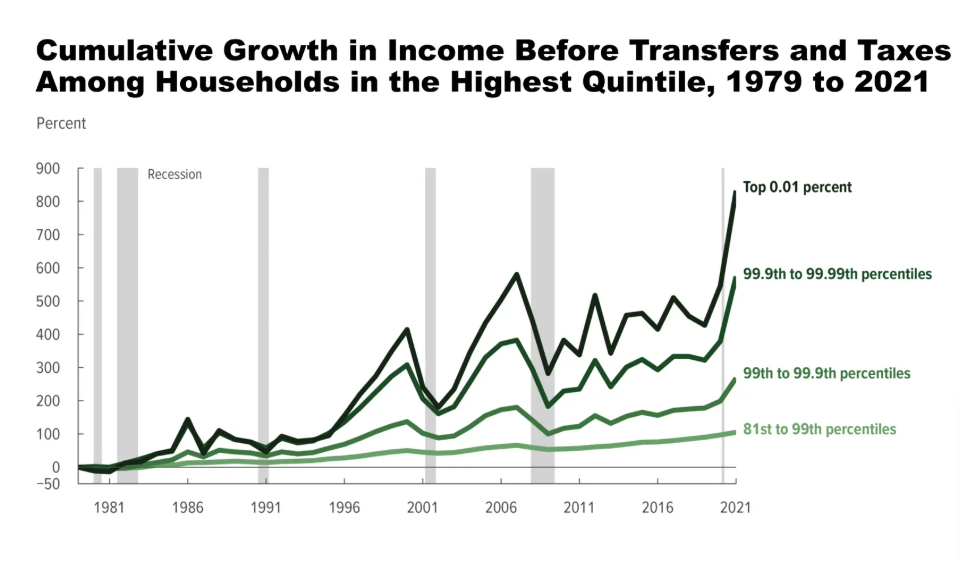

Monies received from business taxes, which had previously accounted for 25% of federal revenue, dropped to just 6.2% by 1983. Not only did businesses receive huge corporate tax cuts, but business owners also saw a 20% decrease in their maximum personal income tax rates—down to 50% from the previous 70%. Who most benefited from these changes? The ultra-rich. Who lost ground? The bottom and middle classes.

In 1986, American workers received an 81.7% share of corporate-sector income. As of April 2025, that figure has dropped to 71.5%. The top one percenters’ wages grew 138% between 1979 and 2015. The rest of us saw a 15% increase over the same period. Inflation, on the other hand, nibbled away at the middle class as prices increased by 188% by the end of 2024 Did American workers just get lazier and less deserving of living wages? No. In fact, productivity is nearly 60% higher.

Deregulation Pads Corporate Pockets

The so-called One Big Beautiful Bill embraces the trickle-down economics theory by not only increasing tax cuts to big business, but also removing what business deems to be government overreach in the form of regulations. This perceived overreach helped to reign in business’ disregard for the environment, consumers and employee health and safety. Even before the OBBB passed, this administration gutted agencies whose role was to protect Americans from corporate greed and misconduct. It has eviscerated the Consumer Financial Protection Bureau, the Department of Agriculture, the Department of Energy and the Environmental Protection Agency. So, in addition to massive tax cuts, big business is now free from providing protection to consumers, labor and the environment.

As a result, corporate America may well realize trillions of dollars in savings over the next decade. Sounds like a win, right? But at what cost?

Increased fossil fuel use threatens health and hastens global warming. (Yes. That’s a thing.)

Decreased banking oversight could result in predatory fees and a banking crisis harkening back to 2008.

Unregulated corporate consolidations could roll-back gains made by labor unions, such as employee safety, working hours and wages.

Loss of services in rural areas, including medical facilities, public transportation, access to affordable food and Internet.One Clear Winner—Corporate America

Opinions are strongly divided on the status of today’s economic policy and are governed primarily by financial status. But corporations win again. The rich get richer, the middle continues its rapid descent into obscurity and the poor get . . .. Well, you know the answer to that one.

Respectfully, submitted.

K. Sabra

The Center for Public Integrity, How four decades of tax cuts fueled inequality., James B. Steele, November 29, 2022

Economic Policy Institute, Nominal Wage Tracker

Economic Policy Institute, Wage Stagnation in Nine Charts, Lawrence Mishel, Elise Gould and Josh Bivens, January 6, 2015.

MSNBC, The dwindling of America’s middle class wasn’t inevitable; it was a policy choice. Ali Velshi, September 1, 2025

Better Markets, Trump’s Deregulation of Wall Street is Going to Economically Crush Main Street Americans, Dennis M Helleher, January 31, 2025

Economic Policy Institute, Identifying the policy levers generating wage suppression adn wage inequality, Lawrence Mishel and Josh Bivens, May 13, 2021

environmentanalyst | global, US EPA’s historic deregulation agenda: the economics don’t add up, Emma Chynoweth, EA, March 20, 2025

PBS, Trump administration moves to repeal EPA rule that allows climate regulation, July 29, 2025